Nor does it have features like tenant screening built-in.įinally, because it’s not targeted at landlords their support documentation and articles don’t offer the same depth and breadth of industry-specific knowledge and educational materials that will help you utilize their platform to grow your portfolio. It also allows you to track your tenants, but it doesn’t have the ability to send templated emails to tenants or automate rent reminders. For example, whilst it facilitates invoice payments, which could be used for rent collection, it doesn’t have a tenant portal or allow for tenants to easily set up automatic rent payments. The second major limitation is that it doesn’t have industry-specific features.

#Quickbooks for mac company setup industry saas software

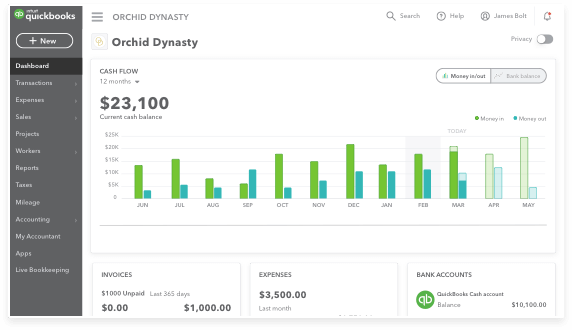

There’s always a learning curve when it comes to adopting a new software, however, when that software isn’t designed to do what you’re asking it then you need end up needing an even more nuanced understanding of the program to make it work for you and for it to actually start saving you time. The first limitation of QuickBooks for rental property is that it’s a challenge to get everything set up correctly. Property management software like Landlord Studio has industry-specific features that are designed specifically to make your rental property management easier. Whilst QuickBooks is the leading accounting software for small businesses, it has limitations when it comes to managing rentals.

The Limitations of QuickBooks for Rental Properties A good property management software will also likely offer property management specific features such as rental listings and tenant screening. This means that unless you are skilled or have a lot of experience with QuickBooks, you may well be better off exploring a property management software that offers this functionality and is designed to make income and expense tracking for your properties as simple as possible. Similarly, the user interface for QuickBooks is not designed for individuals to be managing numerous separate accounts. When setting up spreadsheets this means having a separate sheet for each property and this can quickly get out of hand. The result is that the finances for each property almost need to almost be treated as independent businesses. Essentially, when tracking your income and expenses for your rentals you need to keep your finances for each property separate, ideally on a unit by unit basis. The same issues that make spreadsheets unsuitable for rental portfolios also make QuickBooks a challenge to use for rental properties. QuickBooks is primarily designed for small to mid-sized businesses.

The long answer though is that it’s not quite so simple.

0 kommentar(er)

0 kommentar(er)